What is 6% interest on a $30000 loan?

For this example, the interest calculation is straightforward: a 6% interest rate on $30,000 results in $1,800 in interest over one year. This means, without considering any repayments or additional fees, the cost of borrowing $30,000 for a year at this interest rate would increase the total amount owing to $31,800.

For example, the interest on a $30,000, 36-month loan at 6% is $2,856.

If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005. Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month. If you have a $5,000 loan balance, your first month of interest would be $25.

The monthly payment on a $30,000 loan ranges from $410 to $3,014, depending on the APR and how long the loan lasts. For example, if you take out a $30,000 loan for one year with an APR of 36%, your monthly payment will be $3,014.

With a 30-year, $300,000 loan at a 6% interest rate, you'd pay $347,514.57 in total interest, and on a 15-year loan with the same rate, it'd be $155,682.69 — a whopping $191,831.88 less.

30,000 at 7% per annum is Rs. 4,347.

In today's market, a good mortgage interest rate can fall in the mid-6% range, depending on several factors, such as the type of mortgage, loan term, and individual financial circ*mstances. To understand what a favorable mortgage rate looks like for you, get quotes from a few different lenders and compare them.

On a $400,000 mortgage with an interest rate of 6%, your monthly payment would be $2,398 for a 30-year loan and $3,375 for a 15-year one.

The advertised rate, or nominal interest rate, is used when calculating the interest expense on your loan. For example, if you were considering a mortgage loan for $200,000 with a 6% interest rate, your annual interest expense would amount to $12,000, or a monthly payment of $1,000.

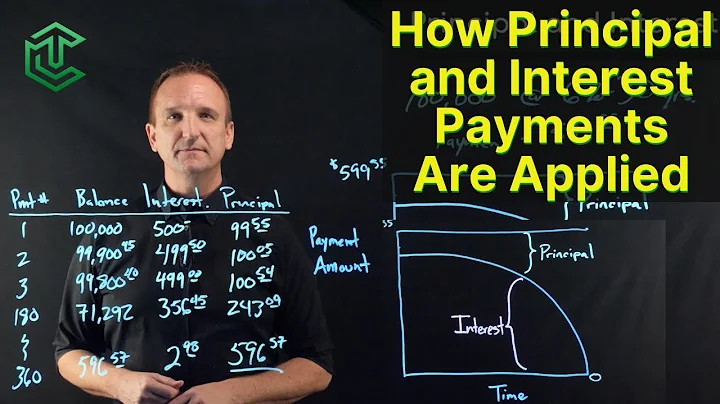

Assuming principal and interest only, the monthly payment on a $100,000 loan with an APR of 6% would be $843.86 on a 30-year term and $599.55 on a 15-year one.

How hard is it to get a $30,000 personal loan?

While you'll generally need good to excellent credit to get approved for a $30,000 personal loan, you might still be able to qualify even if you have poor or fair credit.

If you racked up $30,000 in student loan debt, you're right in line with typical numbers: the average student loan balance per borrower is $33,654. Compared to others who have six-figures worth of debt, that loan balance isn't too bad. However, your student loans can still be a significant burden.

- Make bi-weekly payments. Instead of making monthly payments toward your loan, submit half-payments every two weeks. ...

- Round up your monthly payments. ...

- Make one extra payment each year. ...

- Refinance. ...

- Boost your income and put all extra money toward the loan.

On a $200,000, 30-year mortgage with a 6% fixed interest rate, your monthly payment would come out to $1,199 — not including taxes or insurance.

How much do I need to make for a $300,000 house? A $300,000 house, with a 5% interest rate for 30 years and $15,000 (5%) down will require an annual income of $77,087. This calculation is for an individual with no expenses.

Divide your interest rate by the number of payments you make per year. Multiply that number by the remaining loan balance to find out how much you will pay in interest that month. Subtract that interest from your fixed monthly payment to see how much of the principal amount you will pay in the first month.

The interest rate on a $30,000 loan from a major lender could be anywhere from 7.49% to 35.99%. It's difficult to pinpoint the exact interest rate that you'll get for a $30,000 loan since lenders take many factors into account when calculating your interest rate, such as your credit score and income.

The compound interest on Rs. 30000 at 5% per annum is Rs. 3500.

Answer and Explanation: 3% of 30,000 is 900.

| Institution | Term | Highest APY Available |

|---|---|---|

| Financial Partners Credit Union | 8 months | 6.50% |

| First Financial Federal Credit Union | 9 months | 6.09% |

Is 6 APR good for a loan?

Average APRs

If you are going for more conventional finance such as a PCP deal, and your credit score is near perfect then you are likely to pay around 6% to 11% APR. If you are near-prime (basically meaning you have a good credit score, but it's not excellent) then expect to pay from 12% to 19%.

| Bank | Interest Rate (p.a.) | Processing Fee |

|---|---|---|

| HDFC Bank | 10.5% p.a. - 24.00% p.a. | Up to 2.50% |

| ICICI Bank | 10.50% p.a. - 16.00% p.a. | Up to 2.50% |

| TurboLoan Powered by Chola | 14% p.a. | 4% - 6% |

| Yes Bank | 10.99% p.a. onwards - 20% p.a. | Up to 2% |

The annual salary needed to afford a $400,000 home is about $127,000. Over the past few years, prospective homeowners have chased a moving target: homeownership.

A 100K mortgage payment at 7% interest on a 30-year term is $665.30. For this payment to be less than 28% of your monthly income, your monthly income needs to be over $2,376, assuming you have no debt.

On a $400,000 mortgage with an annual percentage rate (APR) of 3%, your monthly payment would be $1,686 for a 30-year loan and $2,762 for a 15-year one.

References

- https://www.chase.com/personal/mortgage/calculators-resources/affordability-calculator

- https://www.nerdwallet.com/mortgages/mortgage-rates

- https://studentaid.gov/debt-relief-announcement

- https://byjus.com/question-answer/the-compound-interest-on-rs-30000-at-7-per-annum-is-rs-4347-the-period-9/

- https://www.lendingtree.com/student/pay-off-200k-student-loans/

- https://money.usnews.com/loans/personal-loans/articles/how-to-get-a-20-000-personal-loan

- https://www.horizonfcu.org/5-ways-to-pay-off-a-loan-early/

- https://www.credible.com/blog/statistics/average-student-loan-debt-statistics/

- https://studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

- https://www.forbes.com/sites/adamminsky/2023/10/23/3-reasons-your-student-loan-payments-may-be-higher-than-they-should-be/

- https://www.forbes.com/advisor/student-loans/100k-student-loan-monthly-payment/

- https://support.mambu.com/docs/interest-calculation-methods-in-loans

- https://wallethub.com/student-loan-calculator

- https://www.finder.com/mortgages/100000-mortgage

- https://www.sofi.com/learn/content/monthly-cost-100000-mortgage/

- https://www.credible.com/blog/personal-loan/30000-loan/

- https://www.bankrate.com/loans/student-loans/repay-college-loans-fast/

- https://www.fool.com/the-ascent/personal-loans/articles/what-are-the-monthly-payments-on-a-25000-personal-loan/

- https://www.creditkarma.com/advice/i/options-if-you-cant-pay-student-loans

- https://wallethub.com/answers/cc/how-to-pay-off-30000-in-credit-card-debt-1000294-2140754720/

- https://www.mortgageretirementprofessor.com/A%20-%20Interest%20Rates/interest_rate_fundamentals.htm

- https://www.lawinsider.com/dictionary/total-loan-amount

- https://www.nerdwallet.com/article/banking/how-to-calculate-interest-in-a-savings-account

- https://www.gobankingrates.com/money/making-money/best-ways-to-double-5000-dollars/

- https://finance.yahoo.com/news/monthly-payment-20-000-student-112728748.html

- https://www.usnews.com/banking/articles/how-to-calculate-savings-account-interest

- https://www.bankbazaar.com/personal-loan-interest-rate.html

- https://www.credible.com/mortgage/200000-mortgage

- https://www.lendingtree.com/personal/personal-loan-calculator/

- https://www.reinhartlaw.com/news-insights/calculating-interest-the-stated-rate-method-and-the-bank-method

- https://www.thebalancemoney.com/simple-interest-overview-and-calculations-315578

- https://www.cuemath.com/commercial-math/simple-interest/

- https://www.murrieta.k12.ca.us/cms/lib/CA01000508/Centricity/Domain/1467/3-4%20Loan%20Calculations%20and%20Regression.pptx

- https://www.chase.com/personal/credit-cards/education/interest-apr/how-to-calculate-credit-card-apr-charges

- https://wallethub.com/answers/pl/monthly-payment-on-70000-personal-loan-1000450-2140763828/

- https://tools.carboncollective.co/future-value/30000-in-20-years/

- https://www.hippomotorfinance.co.uk/car-finance/what-is-an-apr-rate/

- https://www.mentormoney.com/how-to-pay-off-300000-of-student-loans/

- https://www.forbes.com/advisor/student-loans/how-much-is-too-much-student-debt/

- https://www.investopedia.com/terms/m/maximum_loan_amount.asp

- https://www.jdpower.com/cars/shopping-guides/how-much-would-a-20000-car-loan-cost-each-month

- https://wallethub.com/answers/pl/what-is-the-interest-rate-on-a-30000-personal-loan-1000502-2140800431/

- https://studentaid.gov/help-center/answers/article/what-is-wage-garnishment

- https://www.consumerfinance.gov/ask-cfpb/do-student-loans-affect-my-credit-score-en-581/

- https://www.bankrate.com/loans/personal-loans/how-to-calculate-loan-interest/

- https://wallethub.com/answers/pl/30000-personal-loan-monthly-payment-1000450-2140762727/

- https://homework.study.com/explanation/what-is-3-of-30-000.html

- https://www.fool.com/the-ascent/personal-loans/what-is-good-interest-rate-personal-loan/

- https://money.yahoo.com/much-400-000-mortgage-cost-190052125.html

- https://www.approachfp.com/retire-with-300k/

- https://www.calculator.net/simple-interest-calculator.html

- https://www.bankrate.com/loans/student-loans/which-student-loan-pay-off-first/

- https://www.investopedia.com/ask/answers/100314/what-difference-between-interest-rate-and-annual-percentage-rate-apr.asp

- https://www.equifax.com/personal/education/credit/score/articles/-/learn/what-is-a-good-credit-score/

- https://www.bankrate.com/real-estate/how-much-house-can-i-afford-70k-salary/

- https://www.credible.com/mortgage/100000-mortgage

- https://www.brookings.edu/articles/who-owes-all-that-student-debt-and-whod-benefit-if-it-were-forgiven/

- https://educationdata.org/average-time-to-repay-student-loans

- https://www.fool.com/the-ascent/mortgages/articles/heres-what-happens-when-you-make-an-extra-mortgage-payment/

- https://www.consumerfinance.gov/paying-for-college/student-loan-forgiveness/

- https://wallethub.com/answers/pl/how-much-can-i-borrow-with-a-730-credit-score-1000508-2140806893/

- https://www.aubank.in/blogs/how-does-bank-calculate-interest-on-your-fixed-deposit

- https://wallethub.com/personal-loan-calculator

- https://www.ent.com/education-center/financial-calculators/monthly-loan-payment-calculator/

- https://www.fha.com/define/loan-balance

- https://themortgagereports.com/76824/what-is-a-good-mortgage-rate-today

- https://www.fidelity.com/learning-center/personal-finance/pay-down-debt-vs-invest

- https://www.fortpittcapital.com/resources/calculators/loan-calculator/

- https://www.sparrowfi.com/blog/how-to-pay-off-200k-in-student-loans

- https://www.bestcolleges.com/research/average-student-loan-debt/

- https://www.bankofamerica.com/mortgage/learn/how-to-calculate-home-equity/

- https://www.credible.com/mortgage/400000-mortgage

- https://www.investopedia.com/terms/s/simple_interest.asp

- https://wallethub.com/answers/sl/30000-student-loan-monthly-payment-1000451-2140765109/

- https://wallethub.com/answers/cc/how-long-to-pay-off-30000-credit-card-debt-1000423-2140858502/

- https://www.nerdwallet.com/article/loans/student-loans/do-student-loans-affect-your-credit

- https://www.rocketloans.com/learn/financial-smarts/how-to-calculate-monthly-payment-on-a-loan

- https://studentaid.gov/help-center/answers/article/what-happens-if-i-do-not-pay-back-student-loan

- https://openstax.org/books/contemporary-mathematics/pages/6-8-the-basics-of-loans

- https://studentaid.gov/resources/tax-benefits

- https://www.mortgagecalculator.org/calcs/car.php

- https://www.bestcolleges.com/research/how-long-to-pay-off-student-loans/

- https://www.credible.com/mortgage/300000-mortgage

- https://www.ramseysolutions.com/debt/how-to-pay-off-student-loans-quickly

- https://www.americanfinancing.net/mortgage-basics/mortgage-payment-explained

- https://brainly.com/question/12145863

- https://www.moneygeek.com/personal-loans/calculate-loan-payments/

- https://www.earnest.com/blog/how-much-student-loan-debt-is-too-much/

- https://www.northshorebank.com/calculators/maximum-mortgage-calculator.aspx

- https://www.investopedia.com/loan-calculator-5104934

- https://www.bankrate.com/loans/loan-interest-calculator/

- https://www.credible.com/blog/refinance-student-loans/pay-off-30k/

- https://fortune.com/recommends/mortgages/how-much-salary-to-buy-400000-home/

- https://www.acornfinance.com/blog/personal-loans/35k-personal-loan/

- https://www.fool.com/the-ascent/personal-finance/how-is-loan-amortization-schedule-calculated/

- https://www.businessinsider.com/personal-finance/6-percent-certificate-of-deposit-cd

- https://www.quora.com/The-compound-interest-on-Rs-30000-at-5-per-annum-is-Rs-3500-What-is-the-period-in-years

- https://www.lendingtree.com/student/pay-off-student-loans-faster/

- https://www.bestcolleges.com/research/average-student-loan-payment/

- https://greenlight.com/learning-center/loans/what-increases-your-total-loan-balance

- https://www.credible.com/blog/calculators/personal-loan-calculator/

- https://www.wikihow.com/Find-the-Total-Amount-Paid-in-an-Interest-Rate-Equation

- https://onladder.co.uk/blog/how-to-calculate-mortgage-repayments/

- https://www.investopedia.com/car-loan-calculator-5084761

- https://refi.com/calculator/mortgage-required-income-calculator/

- https://www.credible.com/blog/refinance-student-loans/pay-off-300k/

- https://www.lendingtree.com/student/why-did-my-student-loan-payment-go-up/

- https://www.bankrate.com/loans/student-loans/how-to-calculate-student-loan-interest/

- https://www.investopedia.com/articles/investing/020614/learn-simple-and-compound-interest.asp

- https://www.investopedia.com/terms/r/ruleof72.asp

- https://www.capitalone.com/learn-grow/money-management/what-increases-total-loan-balance/

- https://excel.in30minutes.com/how-to-calculate-monthly-mortgage-payments-in-excel/

- https://www.360financialliteracy.org/Calculators/Bi-weekly-Payment-Calculator3

- https://wallethub.com/answers/sl/monthly-payment-on-100000-student-loan-1000451-2140765188/

- https://www.finder.com/mortgages/300000-mortgage

- https://www.sofi.com/learn/content/tips-to-pay-off-mortgage-in-5-years/

- https://www.quora.com/What-is-6-interest-on-a-30-000-loan